2026 Unemployment Benefits: Eligibility & Payouts Guide

The 2026 unemployment benefits system introduces significant legislative changes impacting eligibility, benefit duration, and weekly payout calculations, demanding a clear understanding for those seeking support.

As we approach 2026, understanding the landscape of 2026 unemployment benefits is more crucial than ever. Recent legislative changes have reshaped who qualifies, for how long, and the amount of weekly payouts. This guide will help you navigate these updates, ensuring you are well-informed about your potential eligibility and the support available.

Understanding the New Legislative Framework for 2026

The year 2026 marks a pivotal moment for unemployment compensation in the United States. Following extensive debates and economic adjustments, federal and state governments have enacted new legislation designed to modernize and, in some cases, streamline the unemployment benefits system. These changes are a direct response to evolving labor market dynamics, technological advancements, and lessons learned from recent economic downturns. The primary goal is to create a more resilient and responsive safety net for workers, while also encouraging re-employment.

One of the most significant shifts involves the increased emphasis on workforce development and retraining initiatives. Lawmakers aim to not only provide temporary financial assistance but also to equip beneficiaries with the skills needed to secure stable employment in emerging industries. This proactive approach seeks to reduce long-term unemployment and foster economic growth. Additionally, there’s a renewed focus on preventing fraud and ensuring the integrity of the system, leading to more stringent verification processes.

Key Federal Adjustments

Federal lawmakers have introduced several overarching changes that will influence state-level programs. These adjustments primarily focus on setting baseline standards for eligibility and benefit duration, ensuring a more uniform approach across states while still allowing for some state-specific flexibility. The intent is to provide a consistent safety net, regardless of an individual’s geographic location.

- Standardized Eligibility Criteria: Federal guidelines now provide clearer, more unified criteria for what constitutes a qualifying separation from employment, aiming to reduce discrepancies between states.

- Extended Benefit Triggers: New federal triggers for extended benefits are tied to broader economic indicators, making it potentially easier for states to access additional funding during severe economic downturns.

- Data Sharing Mandates: Increased data sharing between state workforce agencies and federal bodies is mandated to enhance fraud detection and program efficiency.

These federal adjustments lay the groundwork for a more cohesive national unemployment insurance system, aiming to balance support for the unemployed with fiscal responsibility. States are now tasked with aligning their programs with these new federal directives, which may involve significant overhauls to existing regulations and operational procedures.

In conclusion, the new legislative framework for 2026 represents a comprehensive effort to adapt the unemployment benefits system to current and future economic realities. By focusing on workforce development, fraud prevention, and standardized federal guidelines, the aim is to create a more effective and equitable program for all eligible Americans. Understanding these foundational changes is the first step in navigating the benefits landscape.

Eligibility Requirements: What’s Changed for 2026?

For those seeking financial assistance due to job loss, understanding the updated eligibility requirements for 2026 is paramount. The legislative changes have introduced several modifications that could impact who qualifies for 2026 unemployment benefits. While the core principle remains that benefits are for those who are unemployed through no fault of their own, the specifics of what constitutes ‘no fault’ and other qualifying factors have been refined.

One notable change is the re-evaluation of the base period for earnings. Many states are now considering a more recent base period, allowing for a more accurate reflection of an applicant’s recent work history and earning potential. This can be particularly beneficial for individuals with sporadic employment or those who have recently increased their earning capacity. Additionally, there’s increased scrutiny on job search efforts, with some states implementing stricter requirements for documenting active job-seeking activities.

New Definitions of ‘No Fault’ Separation

The concept of ‘no fault’ separation has been clarified and expanded in some areas, while becoming more stringent in others. Historically, this meant being laid off or terminated for reasons unrelated to misconduct. The 2026 legislation provides more granular definitions for various scenarios:

- Voluntary Quits: While generally disqualifying, exceptions for voluntary quits are now more clearly defined to include situations such as substantial changes in working conditions, caregiving responsibilities, or domestic violence, provided proper documentation is supplied.

- Employer Misconduct: Definitions of employer misconduct leading to a valid separation have been broadened, encompassing issues like unsafe work environments or consistent wage theft, offering more protection to employees.

- Technological Displacement: A new category addresses workers displaced specifically due to automation or AI integration, recognizing the evolving nature of job loss in the modern economy. These individuals may have access to specialized retraining programs alongside their benefits.

These refined definitions aim to address the complexities of modern employment, ensuring that benefits are accessible to those genuinely in need while preventing abuse of the system. Applicants must be prepared to provide detailed documentation to support their claim under these new guidelines.

Furthermore, the legislation has placed a greater emphasis on the availability for work requirement. Applicants must not only be able and available to work but may also be required to participate in skill assessment tests or career counseling sessions. This proactive approach is designed to facilitate a quicker return to employment, aligning with the broader goals of workforce development embedded in the new laws.

In summary, while the fundamental premise of unemployment benefits remains, the 2026 eligibility requirements are more detailed and nuanced. Potential applicants should carefully review the specific criteria in their state, paying close attention to the base period calculations, the definitions of ‘no fault’ separation, and the expectations for active job searching and workforce participation.

Weekly Payouts: How Benefit Calculations are Changing

The weekly payout for 2026 unemployment benefits is a critical concern for anyone facing job loss. The new legislative changes have introduced adjustments to how these benefits are calculated, potentially impacting the financial support individuals receive. While the core formula often involves a percentage of an individual’s past earnings, the specifics of that percentage, the maximum benefit amount, and the duration of benefits have seen revisions.

One significant change in some states is the introduction of a variable benefit duration, tied to economic conditions. Instead of a fixed number of weeks, beneficiaries might receive benefits for a longer or shorter period depending on the state’s unemployment rate and other economic indicators. This dynamic approach aims to provide more support during recessions and encourage faster re-employment during periods of economic growth. Additionally, some states are exploring new ways to factor in dependent allowances, offering a slightly higher benefit for claimants with children or other dependents.

Factors Influencing Your Weekly Benefit Amount

Several key factors will continue to determine your weekly benefit amount, but the 2026 legislation has tweaked how these factors are weighed:

- Base Period Earnings: The total wages earned during your base period (a specific timeframe, typically the first four of the last five completed calendar quarters before you filed your claim) remain the primary determinant. However, some states are now considering a more flexible or extended base period to capture higher recent earnings.

- State-Specific Formulas: Each state employs its own unique formula, usually calculating benefits as a fraction of your average weekly wage during the base period. The percentage used in these calculations may have been adjusted in light of the new federal guidelines or state budgetary considerations.

- Maximum Weekly Benefit Amount (MWBA): The MWBA, which is the highest amount of unemployment benefits a person can receive in a week, has been updated in many states. These adjustments reflect changes in the cost of living and average wages, aiming to keep benefits relevant to current economic realities.

- Dependent Allowances: A growing number of states are implementing or increasing dependent allowances, providing additional funds for beneficiaries with children or other qualified dependents. This is a move to better support families during periods of unemployment.

It’s vital to remember that these calculations are highly state-specific. While federal guidelines provide a framework, the exact percentages, maximums, and duration will vary significantly from one state to another. Therefore, individuals should consult their state’s unemployment agency website for the most accurate and up-to-date information regarding their potential weekly payout.

In conclusion, the calculation of weekly unemployment benefits in 2026 is evolving to be more responsive and, in some cases, more supportive of beneficiaries. With changes to base period considerations, the possibility of variable benefit durations, and updated maximum benefit amounts, understanding these nuances is crucial for financial planning during unemployment. Always verify the specific rules applicable to your state of residence.

Benefit Duration and Extensions in the New Era

The length of time you can receive 2026 unemployment benefits is another aspect significantly impacted by recent legislative changes. Historically, standard benefit duration was often 26 weeks, but this has been subject to considerable variation, especially during economic crises. The new legislation aims to create a more adaptable system that responds to current economic conditions, moving away from rigid, one-size-fits-all policies.

Many states are now adopting a tiered approach to benefit duration. This means that while a baseline number of weeks (e.g., 18-20 weeks) might be standard, additional weeks could become available if the state’s unemployment rate crosses certain thresholds or if specific economic indicators signal a downturn. This dynamic system is designed to provide more robust support when labor markets are weak and to encourage quicker re-entry into the workforce when jobs are more abundant.

Federal and State Extended Benefit Programs

Extended benefit programs, which provide additional weeks of unemployment compensation beyond the standard state duration, are also undergoing revisions. These programs are typically triggered by high unemployment rates and are often cost-shared between federal and state governments. The 2026 legislation has refined these triggers and the mechanisms for funding:

- Modernized Triggers: The criteria for activating federal and state extended benefits have been updated to include a broader range of economic indicators beyond just the insured unemployment rate, offering a more holistic view of labor market health.

- Enhanced Federal Support: In times of severe economic distress, the federal government may provide an increased share of funding for extended benefits, easing the financial burden on states and ensuring that more weeks of assistance are available to those who need them most.

- Workforce Re-engagement Requirements: Alongside extended benefits, some programs now mandate participation in specific workforce re-engagement activities, such as job training, resume workshops, or career counseling, to help beneficiaries transition back into employment.

The goal of these changes is to strike a balance: providing adequate support during prolonged periods of joblessness while simultaneously encouraging and facilitating a return to work. Beneficiaries of extended benefits will likely find a greater emphasis on skill development and job placement services, reflecting the broader legislative intent to invest in human capital.

In conclusion, the duration of unemployment benefits in 2026 is becoming more flexible and responsive to economic conditions. While standard benefit periods remain, the availability of extended benefits is now tied to a more sophisticated set of triggers, with an increased focus on re-employment services. Staying informed about your state’s specific duration rules and any available extensions is crucial for managing your financial stability during unemployment.

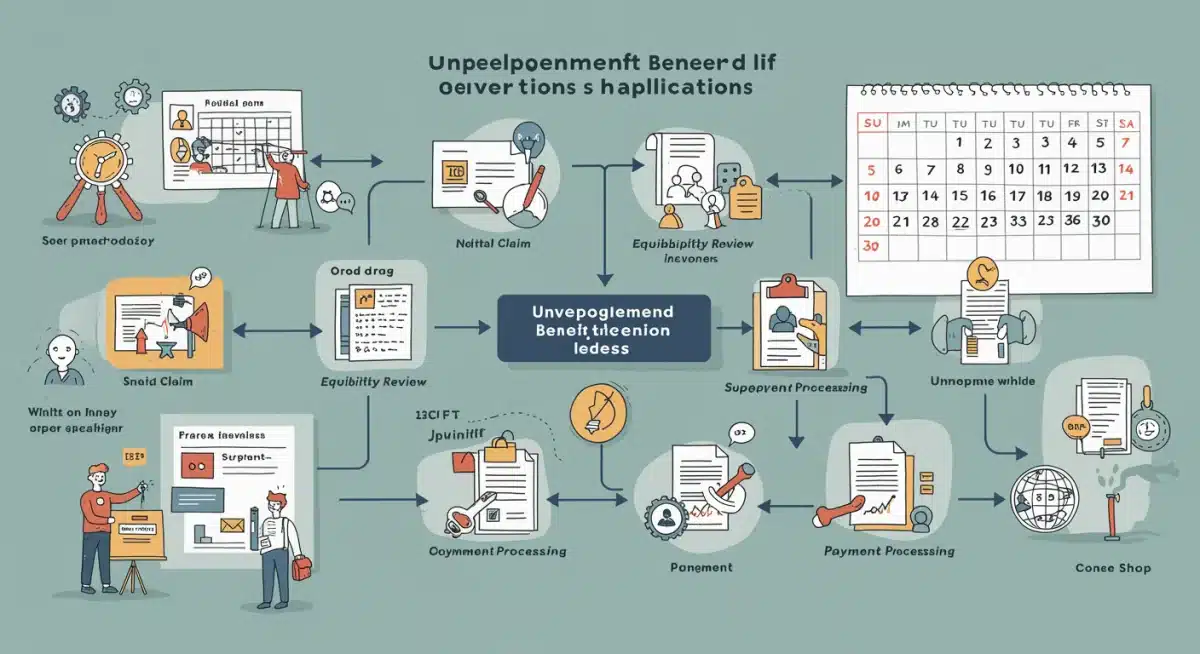

Navigating the Application Process for 2026 Benefits

Applying for 2026 unemployment benefits may feel daunting, but understanding the updated process can significantly streamline your experience. While the fundamental steps of filing an initial claim and certifying for weekly benefits remain, legislative changes have introduced new requirements for documentation, verification, and engagement with workforce services. The aim is to make the process more efficient and secure, while also connecting applicants with resources for re-employment.

Many states are continuing to enhance their online application portals, making it easier to submit claims and manage your benefits digitally. However, these digital platforms often come with more robust identity verification protocols to combat fraud. Applicants should be prepared to provide detailed personal and employment information, and potentially participate in virtual interviews or online assessments.

Essential Steps for a Successful Claim

To ensure a smooth application process for 2026 unemployment benefits, consider the following essential steps:

- Gather Required Documentation: Before starting your application, collect all necessary documents. This typically includes your Social Security number, driver’s license or state ID, employment history for the past 18 months (including employer names, addresses, and dates of employment), reason for separation, and bank account information for direct deposit.

- File Your Claim Promptly: File your claim as soon as you become unemployed. Delays can result in a loss of benefits for the period you waited. Most states allow you to file online, but phone and in-person options may also be available.

- Accurately Report Information: Provide truthful and complete information on your application. Misrepresenting facts can lead to delays, denials, or even penalties. Be precise about your reason for separation and your work search activities.

- Actively Search for Work: Most states require you to actively search for work each week you claim benefits. Keep detailed records of your job search efforts, including the companies you applied to, the dates, and the outcomes. Some states may mandate participation in specific job search workshops or career counseling.

- Certify for Weekly Benefits: After your initial claim is approved, you must certify for benefits each week (or bi-weekly, depending on your state). This involves answering questions about your availability for work, any earnings from part-time jobs, and your continued job search efforts.

The increased focus on workforce re-engagement means that applicants might also be directed to state workforce agencies for additional support. These agencies can offer resources such as job matching services, training programs, and career advisement, all designed to help you find new employment quickly. Engaging with these services can not only fulfill eligibility requirements but also provide valuable tools for your job search.

In conclusion, while the application process for 2026 unemployment benefits has evolved, thorough preparation and adherence to the updated requirements are key to a successful claim. By gathering all necessary documents, filing promptly, accurately reporting information, and actively engaging in job search and re-employment efforts, you can navigate the system effectively and access the support you need.

Impact on Specific Worker Groups and Industries

The legislative changes to 2026 unemployment benefits are not uniform in their impact; certain worker groups and industries may experience unique effects. The evolving nature of the economy, particularly with advancements in automation and artificial intelligence, has led policymakers to consider targeted provisions for those most affected by these shifts. Understanding these specific impacts is crucial for a comprehensive view of the new benefits landscape.

For instance, gig economy workers, who have historically faced challenges in accessing traditional unemployment insurance, might find some new pathways to eligibility. While a universal federal standard for gig worker benefits is still under discussion, some states are piloting programs or adjusting their laws to include these non-traditional employees. This recognition reflects the growing segment of the workforce engaged in contract and freelance work.

Workers in Transitioning Industries

Industries undergoing significant transformation, such as manufacturing, retail, and certain sectors of technology, are particularly affected by the 2026 changes. Workers displaced from these sectors may find enhanced support:

- Retraining and Reskilling Programs: The new legislation places a strong emphasis on connecting displaced workers with comprehensive retraining and reskilling programs, often funded through federal grants. These programs aim to equip individuals with skills for in-demand jobs in emerging sectors.

- Extended Benefit Eligibility: For workers in industries undergoing widespread layoffs due to automation or structural economic changes, there may be provisions for extended benefit eligibility, acknowledging the longer time it might take to acquire new skills and find suitable employment.

- Career Counseling and Placement Services: Specialized career counseling and job placement services are being developed to assist workers from transitioning industries in identifying new career paths and navigating the job market.

Conversely, some industries experiencing rapid growth and labor shortages might see their former employees face stricter job search requirements. The underlying principle is to direct resources where they are most needed while encouraging a swift return to employment in sectors with ample opportunities. The goal is to ensure that the unemployment system supports economic adaptation rather than simply providing a passive safety net.

Furthermore, workers with disabilities or those facing significant barriers to employment may also see adjusted provisions. The legislation aims to reduce systemic hurdles, potentially offering more flexible work search requirements or specialized support services. This inclusive approach recognizes the diverse needs within the unemployed population.

In conclusion, the 2026 unemployment benefits legislation has a nuanced impact across different worker groups and industries. While some, like gig workers or those in transitioning sectors, may find new avenues of support and retraining, others might face more stringent requirements. These targeted provisions reflect an effort to tailor the unemployment system to the complex realities of the modern labor market, fostering both individual well-being and broader economic resilience.

Preparing for Future Changes and Economic Shifts

The dynamic nature of the economy means that 2026 unemployment benefits, while recently updated, will likely continue to evolve. Preparing for future changes and understanding how economic shifts can influence the unemployment system is a proactive step for any worker. Staying informed about legislative discussions, economic forecasts, and labor market trends can help individuals anticipate potential impacts on their eligibility and benefit amounts.

One key trend to monitor is the increasing integration of technology into workforce management and unemployment claims processing. As AI and automation become more sophisticated, the application process might become even more streamlined, but also potentially more impersonal. Workers should be prepared to adapt to digital interfaces and potentially new forms of identity verification.

Strategies for Proactive Preparedness

To best prepare for the future of unemployment benefits and economic shifts, consider these strategies:

- Build an Emergency Fund: Financial experts consistently recommend having an emergency fund covering 3-6 months of living expenses. This provides a crucial buffer during periods of unemployment, regardless of benefit availability.

- Continuously Upskill and Reskill: The labor market is constantly changing. Invest in continuous learning, professional development, and acquiring new skills that are in demand. This makes you more resilient to industry shifts and less reliant on unemployment benefits.

- Stay Informed on Legislation: Regularly check official government websites (federal and state) for updates on unemployment laws, economic stimulus packages, and workforce development initiatives. Subscribing to relevant news alerts can keep you ahead of the curve.

- Maintain Professional Networks: A strong professional network can be invaluable during job transitions. Networking can lead to job opportunities and provide support and advice, potentially reducing the need for unemployment benefits or shortening the duration of unemployment.

- Understand Your State’s Specifics: While federal guidelines exist, much of the unemployment benefit system is managed at the state level. Be familiar with your state’s particular rules regarding eligibility, benefit duration, and application processes, as these are subject to local legislative changes.

The broader economic environment, including inflation rates, interest rates, and global supply chain stability, will also play a significant role in shaping future unemployment policy. A robust economy might lead to stricter benefit requirements, while a downturn could trigger more expansive support programs. Being aware of these macro-economic indicators can provide context for potential policy adjustments.

In conclusion, while the 2026 unemployment benefits represent the current state of affairs, future changes are inevitable. By adopting a proactive approach to financial planning, skill development, and staying informed about legislative and economic trends, individuals can better prepare themselves for any future shifts in the unemployment landscape, ensuring greater financial security and career resilience.

Resources and Support for Unemployed Individuals in 2026

Navigating unemployment can be challenging, but access to the right resources and support systems is vital. Beyond the 2026 unemployment benefits themselves, there are numerous programs and organizations designed to assist individuals in their job search, provide financial counseling, and offer emotional support. The new legislative framework often emphasizes connecting beneficiaries with these resources, recognizing that financial aid is just one component of comprehensive unemployment support.

State workforce agencies, often operating under names like ‘Department of Labor’ or ‘Workforce Development Agency,’ are primary hubs for assistance. These agencies typically offer a wide array of services, from job boards and resume workshops to career counseling and training referrals. Many have updated their digital platforms to make these resources more accessible and personalized for job seekers.

Key Support Services and Where to Find Them

- State Workforce Agencies: These are your first stop for unemployment benefits claims and a wealth of re-employment services. They provide access to job listings, career assessments, training programs, and often host job fairs. Their websites are usually comprehensive and offer guidance on all aspects of the job search.

- CareerOneStop: Sponsored by the U.S. Department of Labor, CareerOneStop is a national resource that helps job seekers find local training, education, and job opportunities. It offers tools for resume building, skill assessments, and information on various careers.

- Community Colleges and Vocational Schools: Many educational institutions offer short-term training programs and certifications designed to help unemployed individuals acquire new skills quickly. Some of these programs may be subsidized or free for eligible participants, especially those linked to workforce development initiatives.

- Non-Profit Organizations: Numerous non-profits offer specialized support, including resume writing assistance, interview coaching, financial literacy workshops, and even mental health services for those affected by job loss. Organizations like Goodwill, United Way, and local community centers often have relevant programs.

- Financial Counseling Services: If you’re struggling to manage your finances while unemployed, non-profit credit counseling agencies can offer free or low-cost advice on budgeting, debt management, and financial planning.

The legislative push for workforce development means that many of these support services are now more integrated with the unemployment benefits system. Beneficiaries may be required to engage with certain services to maintain eligibility, but these requirements are framed as opportunities to enhance re-employment prospects rather than mere hurdles. Taking advantage of these resources can significantly shorten the duration of unemployment and lead to more stable, rewarding employment.

In conclusion, while 2026 unemployment benefits provide crucial financial relief, a holistic approach to navigating job loss involves leveraging the extensive network of available resources. From state workforce agencies to educational institutions and non-profit organizations, a wide range of support services can assist individuals in their job search, skill development, and financial well-being. Actively engaging with these resources is a proactive step toward successful re-employment and long-term career stability.

| Key Change Area | Brief Impact Summary |

|---|---|

| Eligibility Criteria | Refined definitions for ‘no fault’ separation and base period earnings; stricter job search expectations. |

| Weekly Payouts | Adjustments to state-specific formulas and Maximum Weekly Benefit Amounts (MWBA); potential for dependent allowances. |

| Benefit Duration | Introduction of variable benefit durations tied to economic conditions; modernized triggers for extended benefits. |

| Application Process | Enhanced digital platforms and identity verification; increased focus on workforce re-engagement services. |

Frequently Asked Questions About 2026 Unemployment Benefits

Eligibility for 2026 unemployment benefits is primarily determined by your state’s specific laws, which now align with new federal guidelines. Generally, you must be unemployed through no fault of your own, meet minimum earnings requirements during a base period, and be actively seeking work. Check your state’s Department of Labor website for precise criteria and updated definitions.

Yes, weekly payout amounts may differ in 2026. Many states have adjusted their benefit calculation formulas, Maximum Weekly Benefit Amounts (MWBA), and some have introduced or increased dependent allowances. These changes reflect economic conditions and legislative updates. Your individual payout will depend on your past earnings and your state’s current formula.

The 2026 legislation emphasizes more robust job search requirements. Claimants are generally expected to actively seek and document a certain number of job contacts each week. Some states may also mandate participation in career counseling, skill assessments, or workforce development programs to maintain eligibility. Always consult your state’s specific guidelines for detailed expectations.

While traditional unemployment insurance typically covers W-2 employees, some states are exploring or implementing new provisions for gig workers and self-employed individuals in 2026, often in response to evolving labor markets. Eligibility remains complex and highly state-dependent. It’s crucial to check with your state’s unemployment agency for specific programs or classifications that might apply to you.

The duration of 2026 unemployment benefits has become more flexible. While a standard number of weeks exists in each state, many have adopted variable durations tied to economic indicators. Extended benefits programs, triggered by high unemployment rates, may also provide additional weeks. Check your state’s Department of Labor for current duration limits and potential extensions.

Conclusion

The 2026 unemployment benefits landscape represents a significant evolution in how the United States supports its workforce during periods of joblessness. From refined eligibility criteria and altered weekly payout calculations to more dynamic benefit durations and enhanced re-employment resources, these legislative changes aim to create a more responsive and effective system. Understanding these updates is not merely about navigating a bureaucratic process; it’s about empowering yourself with knowledge to secure vital financial support and leverage available programs for a successful return to the workforce. Staying informed and proactive will be your greatest asset in this new era of unemployment compensation.