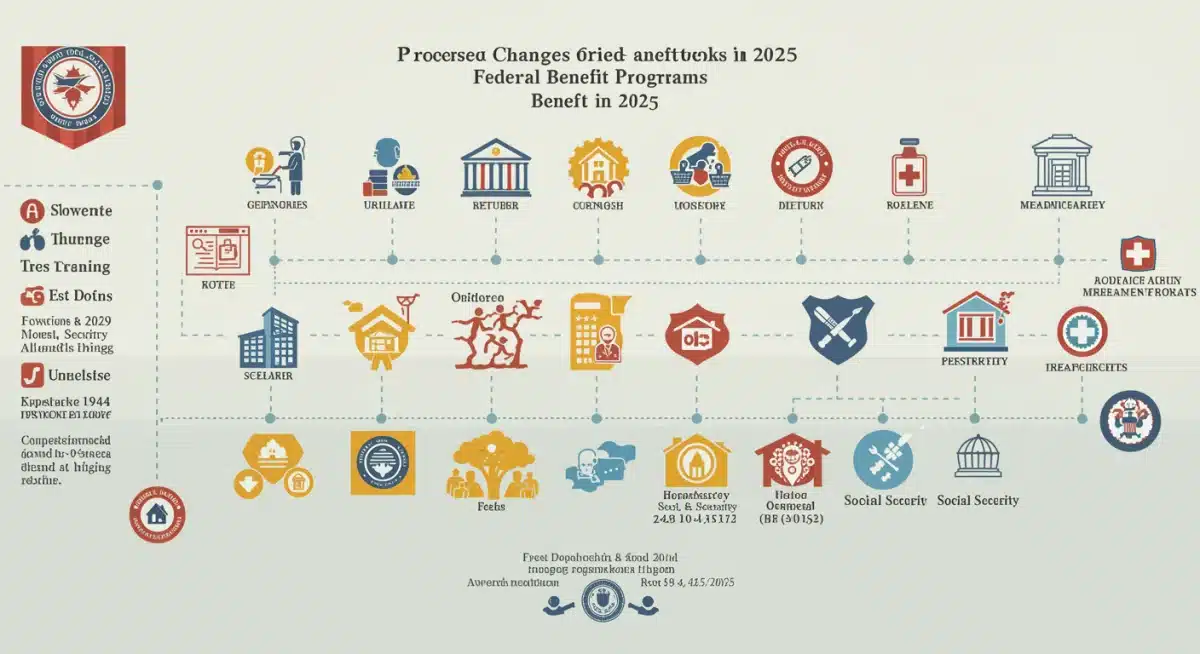

New Federal Benefits 2025: Program Changes & Eligibility Updates

Understanding the upcoming adjustments to federal benefits in 2025 is essential for navigating program changes, eligibility criteria, and maximizing available government support effectively.

As we approach 2025, significant shifts are on the horizon for various federal benefit programs. Staying informed about these changes is not just important, it’s critical for anyone relying on government assistance. This article will delve into the particulars of new federal benefits in 2025, outlining upcoming program changes and eligibility updates that could directly impact you and your family. Prepare to understand what’s coming and how to best navigate these evolving landscapes.

Understanding the Drivers Behind 2025 Federal Benefit Changes

The continuous evolution of federal benefit programs is influenced by a complex interplay of economic factors, legislative priorities, and societal needs. These changes are rarely arbitrary; instead, they reflect broader governmental strategies to address challenges such as inflation, an aging population, and shifts in the labor market. Understanding these underlying drivers provides crucial context for why certain adjustments are made, helping beneficiaries anticipate and adapt.

Economic indicators, such as the Consumer Price Index (CPI), often dictate cost-of-living adjustments (COLAs) for programs like Social Security. Legislative actions, influenced by political shifts and public demand, can introduce entirely new programs or significantly alter existing ones. Demographics also play a vital role, with an increasing number of retirees, for example, placing different demands on healthcare and retirement benefits. These interconnected forces ensure that federal benefits remain a dynamic and responsive system.

Economic Influences on Benefit Adjustments

Inflation rates and economic growth are primary determinants of benefit payment amounts. When the cost of living increases, federal programs often adjust payments to maintain beneficiaries’ purchasing power. This is particularly evident in programs designed to support vulnerable populations.

- Inflation: Directly impacts cost-of-living adjustments (COLAs) for Social Security and other indexed benefits.

- Wage Growth: Affects calculations for future benefit amounts and program solvency.

- Budgetary Constraints: Can lead to adjustments in program funding, potentially impacting benefit levels or eligibility.

Legislative and Policy Shifts

New laws and policy directives from Congress and federal agencies can introduce sweeping changes. These might include expanding eligibility to new groups, modifying benefit calculations, or even creating entirely new benefit categories to address emerging needs.

The rationale behind these legislative changes often involves balancing fiscal responsibility with the imperative to provide a safety net for citizens. Debates around healthcare, housing, and food security frequently lead to amendments in a variety of federal programs. Public advocacy and research also contribute to shaping policy, ensuring that benefits align with current societal challenges.

In essence, the changes anticipated in 2025 are a culmination of these various pressures. They aim to refine the system, making it more equitable, sustainable, and responsive to the real-world conditions faced by millions of Americans. Staying informed about these drivers can empower individuals to better understand the rationale behind the modifications.

Key Changes to Social Security and Medicare in 2025

Social Security and Medicare are two cornerstones of federal benefits, providing vital support to millions of Americans. In 2025, both programs are slated for important adjustments that could affect retirees, individuals with disabilities, and seniors. Understanding these specific changes is paramount for financial planning and accessing necessary healthcare services.

For Social Security, adjustments typically involve cost-of-living increases, changes to the earnings limit for those working while receiving benefits, and modifications to the maximum taxable earnings. Medicare, on the other hand, often sees shifts in premiums, deductibles, and covered services. These changes are designed to ensure the long-term solvency and effectiveness of these critical programs, but they also require beneficiaries to stay vigilant about their personal situations.

Anticipated Social Security Adjustments

The Cost-of-Living Adjustment (COLA) for Social Security benefits is a highly anticipated announcement each year, directly impacting the monthly payments received by retirees and other beneficiaries. While the exact percentage for 2025 will be determined later, it will reflect inflation trends.

- COLA Projections: Based on current economic forecasts, a moderate COLA is expected for 2025, aimed at helping beneficiaries keep pace with rising costs.

- Earnings Limit: The amount individuals can earn before their Social Security benefits are reduced is likely to increase, offering more flexibility for those who continue to work.

- Maximum Taxable Earnings: The wage base subject to Social Security taxes is also expected to rise, affecting higher-income earners.

Medicare Updates for 2025

Medicare Part A (hospital insurance) and Part B (medical insurance) will see adjustments in premiums, deductibles, and co-payments. These changes are influenced by healthcare costs, utilization rates, and legislative decisions aimed at strengthening the program.

Additionally, there may be updates to Medicare Advantage plans (Part C) and Part D prescription drug coverage, including changes to formularies and out-of-pocket maximums. It’s crucial for beneficiaries to review their plan options annually during the open enrollment period to ensure they have the most suitable and cost-effective coverage.

These updates for Social Security and Medicare underscore the importance of proactive engagement. Beneficiaries should consult official Social Security Administration and Medicare resources to get the most accurate and personalized information regarding their benefits in 2025. Planning ahead based on these anticipated changes can help individuals optimize their financial and health outcomes.

Changes in Housing and Food Assistance Programs

Federal programs designed to provide housing and food assistance are crucial for millions of low-income families and individuals across the United States. In 2025, several of these programs are expected to undergo modifications aimed at enhancing efficiency, expanding reach, or adjusting to economic realities. These changes can significantly impact access to affordable housing and nutritious food.

Updates might include revised income eligibility thresholds, changes in how benefits are calculated, or new initiatives to address specific housing and food insecurity challenges. These adjustments often reflect a balancing act between providing adequate support and ensuring the fiscal sustainability of the programs. Beneficiaries need to be aware of these potential shifts to maintain their access to vital resources.

Housing Assistance Program Modifications

Programs like Section 8 (Housing Choice Vouchers) and Public Housing are often subject to adjustments in funding, eligibility, and administrative rules. These changes can affect waitlists, the amount of rental assistance provided, and the types of housing available.

- Income Limits: Federal poverty guidelines and local median incomes are frequently updated, potentially altering who qualifies for housing assistance.

- Program Funding: Congressional appropriations can lead to increases or decreases in the number of available vouchers or housing units.

- Streamlined Applications: Efforts may be made to simplify the application process, making it easier for eligible individuals to apply.

Updates to Federal Food Assistance Programs

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, and other related nutrition programs are often reviewed for effectiveness and updated to better serve populations facing food insecurity. Changes can include adjusted benefit amounts, modified eligibility rules, and new initiatives to promote healthy eating.

These adjustments are crucial for ensuring that individuals and families have access to sufficient and nutritious food. Policy debates often focus on the balance between providing a robust safety net and encouraging self-sufficiency. Understanding these nuances is key for beneficiaries to continue receiving the support they need.

It is advisable for individuals receiving or seeking housing and food assistance to regularly check with their local housing authorities and state SNAP offices. These local agencies are typically the first to implement federal changes and can provide the most current information regarding eligibility and application procedures for 2025.

Eligibility Updates Across Various Federal Programs

Beyond the major pillars of Social Security, Medicare, housing, and food assistance, numerous other federal programs provide targeted support for specific needs, such as education, unemployment, and disability. Many of these programs are also expected to see eligibility updates in 2025, reflecting evolving economic conditions, legislative priorities, and administrative reviews. These changes can be subtle yet have a significant impact on who qualifies for assistance.

Eligibility criteria are often tied to income levels, household size, geographic location, and specific circumstances like veteran status or disability. Keeping track of these varied requirements across different programs can be challenging, but it is essential for ensuring continued access to benefits. The goal of these updates is often to refine the targeting of resources to those most in need, or to adapt programs to new challenges.

Education and Student Aid Revisions

Federal student aid programs, including Pell Grants and federal loans, are frequently adjusted to respond to changes in college costs and student demographics. In 2025, there may be updates to the Free Application for Federal Student Aid (FAFSA) process or to the income thresholds for grant eligibility.

- FAFSA Simplification: Ongoing efforts to simplify the FAFSA could make it easier for students to apply for financial aid.

- Pell Grant Eligibility: Income and family contribution calculations for Pell Grants may be revised, potentially expanding access for some students.

- Loan Repayment Terms: Changes to federal student loan repayment plans or forgiveness programs could also be introduced.

Unemployment and Disability Benefit Adjustments

Unemployment insurance programs, primarily administered at the state level but with federal oversight, may see adjustments in benefit duration or eligibility conditions, particularly in response to economic forecasts. Similarly, disability benefits, such as Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI), could have updated medical criteria or income limits.

These programs serve as critical safety nets during times of job loss or severe health challenges. Any changes to their eligibility requirements can have profound effects on individuals and families. Therefore, it is important for potential beneficiaries to consult official government websites and relevant agencies for the most up-to-date information specific to their situation.

The landscape of federal benefits is intricate, and eligibility often depends on a confluence of factors. Proactive research and direct communication with program administrators will be key for anyone seeking to understand their qualification status for various federal programs in 2025.

Navigating the Application Process and Resources for 2025

With anticipated changes to federal benefits in 2025, understanding how to navigate the application process and where to find reliable resources becomes more critical than ever. The procedures for applying for benefits can sometimes be complex, requiring specific documentation and adherence to deadlines. Staying organized and informed can significantly ease this process.

Many federal agencies are continuously working to streamline their application portals and provide clearer guidance, but individual responsibility in seeking out accurate information remains paramount. Knowing where to look for official updates and how to prepare necessary paperwork will be key to successfully accessing benefits in the coming year.

Streamlining Your Application

Preparing for the application process involves more than just filling out forms. It requires gathering all necessary documents, understanding deadlines, and potentially seeking assistance if needed. Many programs now offer online application portals, which can often be more efficient than traditional paper applications.

- Document Checklist: Always have personal identification, proof of income, residency, and other program-specific documents ready.

- Online Portals: Utilize official government websites for applications, as these are often updated first with new requirements.

- Deadlines: Be mindful of application windows and submission deadlines to avoid missing out on benefits.

Official Resources and Support

Relying on official government websites and direct agency contacts is the safest way to get accurate information about federal benefit changes and application procedures. Avoid third-party sites that may offer outdated or incorrect advice.

Organizations that provide free assistance to applicants, such as legal aid societies, senior centers, or local community service agencies, can also be invaluable resources. These groups often have staff trained to help with complex applications and appeals.

For individuals seeking to understand and apply for new federal benefits in 2025, the emphasis should be on proactive engagement with official sources. Regularly checking agency websites, subscribing to official newsletters, and attending informational webinars can help ensure that you are well-prepared for any changes and can successfully navigate the application landscape.

Impact on Specific Demographics: Seniors, Veterans, and Families

Federal benefit changes in 2025 will not affect all Americans uniformly; certain demographic groups often experience a more direct and significant impact. Seniors, veterans, and families with children are frequently the primary recipients of various federal programs, making it essential to examine how upcoming adjustments will specifically influence their well-being and access to support. Understanding these targeted impacts allows for more precise planning and advocacy.

Seniors rely heavily on Social Security and Medicare, while veterans benefit from specific programs administered by the Department of Veterans Affairs. Families with children often depend on programs related to childcare, education, and nutrition. Each of these groups faces unique challenges and receives tailored support, meaning even minor program modifications can have substantial consequences for their daily lives.

Seniors and Retirement Benefits

For seniors, changes to Social Security’s Cost-of-Living Adjustment (COLA) and Medicare premiums are always a top concern. These adjustments directly influence their fixed incomes and healthcare costs, which are critical components of their financial security in retirement.

- Healthcare Costs: Fluctuations in Medicare Part B premiums and deductibles can impact disposable income and access to medical care.

- Supplemental Support: Programs like Supplemental Security Income (SSI) may also see adjustments to income and asset limits, affecting low-income seniors.

Veterans’ Benefits and Services

Veterans’ benefits encompass a wide range of services, including healthcare, disability compensation, education, and housing assistance. Changes in 2025 could involve modifications to eligibility for specific programs, adjustments to compensation rates, or enhancements to mental health services.

The Department of Veterans Affairs (VA) regularly reviews its programs to ensure they meet the evolving needs of service members and their families. Veterans should pay close attention to updates regarding their specific entitlements, particularly those related to disability ratings and healthcare access.

Families with Children

Families often benefit from programs such as the Child Tax Credit, SNAP, and various educational aid initiatives. Any changes to these programs’ eligibility criteria or benefit amounts can directly impact household budgets and children’s access to vital resources.

Policy discussions around family support frequently center on issues like poverty reduction, childcare affordability, and educational attainment. Consequently, families should monitor legislative developments and agency announcements to understand how federal benefits will adapt to support their unique needs in 2025.

In summary, the specific impacts of 2025 federal benefit changes will vary across demographics. Targeted communication and accessible resources are crucial for ensuring that seniors, veterans, and families are fully aware of how these adjustments will affect them and how they can continue to access the support they are entitled to.

Preparing for Future Federal Benefit Changes: A Proactive Approach

Anticipating and preparing for future federal benefit changes is not merely about reacting to announcements but adopting a proactive strategy. The dynamic nature of these programs means that continuous vigilance and informed decision-making are essential for beneficiaries and those planning to rely on federal support. A proactive approach involves staying informed, reviewing personal finances, and seeking expert advice when necessary.

Ignoring potential changes can lead to missed opportunities or unexpected financial challenges. By taking steps now, individuals can better position themselves to adapt to new regulations, maximize their benefits, and ensure long-term financial stability. This forward-thinking mindset is key to navigating the evolving landscape of federal assistance.

Strategies for Staying Informed

The most effective way to prepare is to consistently monitor official sources for updates. Government agencies are the primary and most reliable providers of information regarding their respective programs.

- Official Websites: Regularly check websites for the Social Security Administration, Medicare, Department of Veterans Affairs, and other relevant agencies.

- Subscribe to Newsletters: Many agencies offer email newsletters that provide timely updates on program changes and deadlines.

- Consult Reputable News Outlets: Follow news sources that specialize in reporting on government policy and benefit programs.

Financial Planning and Professional Advice

Understanding how benefit changes might affect your personal finances is a crucial step. This might involve reviewing your budget, savings, and retirement plans in light of potential adjustments to income or expenses related to benefits.

For complex situations, consulting with financial advisors, elder law attorneys, or benefit specialists can provide tailored guidance. These professionals can help interpret new regulations and develop strategies to optimize your benefits and overall financial health.

Ultimately, a proactive approach to new federal benefits in 2025 empowers individuals to maintain control over their financial future. By staying informed, planning carefully, and leveraging available resources, beneficiaries can confidently navigate the upcoming changes and continue to access the support they need.

| Key Point | Brief Description |

|---|---|

| Social Security COLA | Anticipated cost-of-living adjustment to help benefits keep pace with inflation. |

| Medicare Premiums | Expected adjustments to Part A & B premiums, deductibles, and co-payments. |

| Housing & Food Aid | Possible changes to income limits and program funding for housing vouchers and SNAP. |

| Eligibility Updates | Revisions to criteria for various programs, including education and disability benefits. |

Frequently asked questions about 2025 federal benefits

Federal benefit changes in 2025 are primarily driven by economic factors like inflation and wage growth, legislative actions by Congress, and demographic shifts such as an aging population. These elements collectively shape adjustments to ensure programs remain relevant and sustainable for beneficiaries.

The Social Security Cost-of-Living Adjustment (COLA) for 2025 is expected to provide a moderate increase to monthly benefits. This adjustment aims to help beneficiaries maintain their purchasing power against inflation. The exact percentage will be announced later in the year.

Yes, Medicare Part A and Part B premiums, deductibles, and co-payments are likely to see adjustments in 2025. These changes are influenced by overall healthcare costs and program utilization. Beneficiaries should review their options during the annual open enrollment period.

To prepare for housing and food assistance changes, regularly check with your local housing authority and state SNAP offices. Be ready with updated income and residency proofs, as eligibility criteria and benefit amounts may be revised in 2025.

Official information about new federal benefits in 2025 can be found on the respective government agency websites, such as the Social Security Administration, Medicare.gov, and the Department of Veterans Affairs. Subscribing to their official newsletters is also highly recommended.

Conclusion

The anticipated changes to federal benefits in 2025 underscore a critical need for vigilance and proactive engagement from all beneficiaries and those who might rely on these programs in the future. From adjustments in Social Security and Medicare to modifications in housing, food, and other specialized assistance, the landscape of government support is continuously evolving. Understanding these updates, reviewing eligibility criteria, and preparing for application processes are essential steps to ensure continued access to vital resources. By staying informed through official channels and planning strategically, individuals can effectively navigate the complexities of these changes and secure the benefits they are entitled to, fostering greater financial stability and well-being.