Student Loan Debt 2026: New Repayment & Forgiveness

In 2026, over 40 million Americans grappling with student loan debt can anticipate significant changes, including new repayment options and potential forgiveness programs designed to alleviate financial burdens and offer clearer paths to debt relief.

Online vs. In-Person Degrees 2026: ROI for US Students

Choosing between online and in-person degrees in 2026 demands a close look at return on investment for US students, considering evolving job markets and educational technologies.

2026 Unemployment Benefits: Eligibility & Payouts Guide

The 2026 unemployment benefits system introduces significant legislative changes impacting eligibility, benefit duration, and weekly payout calculations, demanding a clear understanding for those seeking support.

2026 Energy Policy Overhaul: Utility Cost Impacts

The 2026 energy policy overhaul fundamentally reshapes the US energy landscape, introducing new regulations that will significantly impact utility costs for consumers and businesses nationwide, driven by sustainability and infrastructure modernization.

Investment Strategies for a Volatile 2026

Protecting your capital and achieving a 15% diversified portfolio growth in a volatile 2026 requires strategic asset allocation, embracing alternative investments, and vigilant risk management amidst evolving global economic shifts.

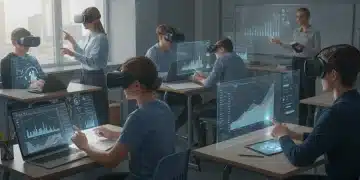

2026 EdTech Trends: What US Parents & Students Need to Know

The 2026 education technology trends are fundamentally reshaping US classrooms, offering parents and students new pathways for personalized learning, immersive experiences, and crucial digital skills. Understanding these advancements is key to navigating the evolving educational landscape.