Heart financial literacy in schools: why it matters

Integrating financial literacy in schools equips students with essential skills to manage money, make informed decisions, and contribute positively to their communities.

Heart financial literacy in schools is not just a buzzword; it’s a necessary skill for life. Have you considered how understanding money management can shape a student’s future? In this article, we delve into its significance and explore practical steps for implementation.

Understanding financial literacy and its importance

Understanding financial literacy is crucial for equipping students with the skills they need to manage their money effectively. Many young people enter adulthood without basic knowledge of finance, which can lead to poor financial decisions. Teaching financial literacy helps students understand the value of money and the importance of planning for their future.

What is financial literacy?

Financial literacy refers to the ability to make informed and effective decisions regarding personal financial management. This includes budgeting, saving, investing, and understanding credit. When students are aware of these concepts, they are better prepared to navigate the complexities of financial life.

Importance of financial literacy

Having strong financial skills can lead to several benefits:

- Improved budgeting skills that can help in managing daily expenses.

- Increased savings for emergencies and future goals.

- Better understanding of loans and interest rates.

- Ability to invest wisely and build wealth over time.

Moreover, financial literacy empowers students to avoid excessive debt and make smart choices about their education and career paths. A solid foundation in finance can lead to enhanced confidence in handling financial matters.

As the world grows increasingly complex, the value of financial literacy continues to rise. In a society where many are burdened by debt, being educated about finances can make a significant difference. Schools that prioritize teaching financial literacy are helping to create a generation that is financially savvy and prepared for the challenges ahead. This investment in education not only benefits individual students but also contributes to healthier financial communities.

Key benefits of financial literacy for students

Financial literacy offers numerous benefits for students that help shape their futures. It enables them to make informed choices regarding spending and saving, which is vital in today’s world. When students learn about money management, they gain confidence in their ability to handle financial matters effectively.

Improved Decision-Making Skills

One of the key benefits of financial literacy is enhanced decision-making skills. With a strong financial foundation, students can evaluate their options and make better choices about their money. This understanding helps them to stick to their budgets and avoid impulsive purchases.

Building a Strong Financial Future

Having financial knowledge allows students to start planning for their financial future early. They learn the importance of saving for emergencies and larger goals. When they grasp the concept of compound interest, they are more likely to put money into savings accounts or consider investing.

Understanding Credit

Another important aspect of financial literacy is the understanding of credit. Students who are knowledgeable about credit scores and reports are better prepared to take on loans responsibly. Knowing how to build and maintain good credit can lead to lower interest rates and better opportunities in the future.

- Students become aware of the costs associated with borrowing money.

- They learn strategies to improve their credit scores.

- They understand their rights and responsibilities related to credit.

Financial literacy also helps students avoid common pitfalls, such as excessive debt or financial scams. Through education, they can recognize warning signs and protect themselves. Furthermore, financially literate students are more likely to seek out advice and resources when unsure about financial decisions.

As students equip themselves with these skills, they become empowered to take control of their financial lives. This knowledge not only benefits them individually but also contributes positively to society as a whole. When students are financially literate, they are more likely to contribute to a stable economy.

How to integrate financial literacy into the curriculum

Integrating financial literacy into the curriculum is essential for preparing students for real-life financial challenges. Schools can start by embedding financial concepts into existing subjects, making learning more relevant and practical. This approach not only increases engagement but also provides students with a well-rounded education.

Using Cross-Disciplinary Methods

Teachers can incorporate financial topics into various courses:

- Math: Teach budgeting and percentages through projects involving real-life scenarios.

- Social Studies: Discuss the economic impacts of financial decisions made by individuals and communities.

- Business Classes: Offer hands-on activities and simulations that require students to manage a budget or create a business plan.

By connecting financial literacy to different subjects, students see its relevance in everyday life. This also fosters critical thinking as they analyze different perspectives on financial choices.

Practical Activities and Projects

Creating opportunities for practical learning can make financial literacy more impactful. Engaging students in projects can help solidify their understanding:

- Host a school-wide budgeting competition where students manage a mock budget for a fictional event.

- Organize workshops with guest speakers from local businesses to discuss real-world financial management.

- Implement service projects that encourage students to save and contribute to charity.

These activities not only teach valuable lessons about money but also encourage teamwork and collaboration.

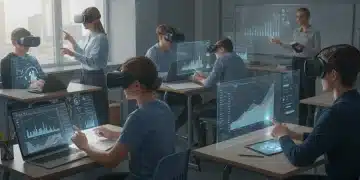

Another effective method is to utilize technology. Websites and apps focused on financial education can enhance learning experiences. Students can explore simulations or educational games that make understanding finance entertaining.

By integrating financial literacy into the curriculum using these methods, schools provide students with the tools they need to succeed financially. It prepares them for responsible financial decision-making both now and in the future.

Tools and resources for teaching financial literacy

Teaching financial literacy effectively requires the right tools and resources. Fortunately, there are many available that can make lessons engaging and informative. Utilizing various resources helps teachers convey important concepts that resonate with students.

Educational Websites

Many websites offer comprehensive resources for teaching financial literacy:

- Khan Academy: Provides free online courses on personal finance, including budgeting, saving, and investing.

- Jump$tart: Offers a network of financial education resources and lesson plans tailored for various grade levels.

- National Endowment for Financial Education (NEFE): Features resources designed for teachers to instill financial knowledge in students.

These platforms provide interactive learning opportunities that help students connect with financial topics in meaningful ways.

Books and Printed Materials

In addition to online resources, books can be an excellent tool for engaging students:

- “The Total Money Makeover” by Dave Ramsey: Teaches comprehensive money management strategies.

- “The Everything Kids’ Money Book” by Brette Sember: Simplifies finance concepts for younger audiences.

- “How to Make Your Money Last” by Jane Bryant Quinn: Offers useful information on financial planning.

These materials can be supplemented by worksheets and activities that reinforce the lessons learned.

Incorporating technology in the classroom also enhances the learning experience. Mobile apps and software can provide simulations and scenarios for students to practice their financial skills. Apps like Mint and You Need a Budget (YNAB) can allow students to track their expenses, helping them grasp budgeting concepts more effectively.

Finally, involving the community can be beneficial. Local banks or financial institutions often offer workshops and guest speakers who can share real-world experiences. Connecting students with professionals can boost their interest and understanding of financial literacy.

By integrating these tools and resources, educators can create a dynamic and effective learning environment for teaching financial literacy. This not only engages students but also prepares them for a successful financial future.

Success stories from schools implementing financial literacy

Many schools around the country have successfully implemented financial literacy programs, demonstrating the positive impact such education can have on students. These success stories illustrate effective strategies and the benefits students reap from learning about financial management early on.

Case Study: Lincoln High School

Lincoln High School introduced a comprehensive financial literacy program that integrated lessons into math and economics classes. Students learned about budgeting, saving, and investing through real-life projects.

- Students created personal budgets based on hypothetical income.

- They participated in a stock market simulation, which sparked interest in investing.

- As a result, many students reported feeling more confident about managing their finances.

This integration showed how financial literacy could be engaging while offering practical skills.

Case Study: Riverside Middle School

Riverside Middle School focused on experiential learning by hosting a financial literacy fair. Local banks partnered with the school, providing interactive booths and workshops on various topics like saving for college and understanding credit.

- Workshops included hands-on activities, such as calculating the costs of different education pathways.

- Students learned about different financial educational tools through group discussions.

- Feedback from parents indicated they noticed a change in their children’s attitudes towards money.

This community involvement not only enhanced the educational experience but also established vital connections between students and local financial institutions.

Another inspiring example comes from Maple Grove Elementary, where younger students learned through age-appropriate games and activities. By using fun, interactive methods, students grasped foundational concepts such as saving and recognizing needs versus wants.

The impact of these programs extends beyond individual schools. Students equipped with financial literacy skills may potentially contribute to healthier economies by making informed financial decisions throughout their lives. These success stories highlight how effective programs inspire students to take charge of their financial futures.

In conclusion, integrating financial literacy into school curricula is essential for student success. By providing practical skills and knowledge, schools equip students to make informed financial decisions. Success stories from various schools prove that programs can be engaging and impactful. Students learn valuable lessons that not only prepare them for their future but also enhance the financial health of communities. The emphasis on financial literacy today will foster responsible, financially savvy adults tomorrow.

FAQ – Frequently Asked Questions about Financial Literacy in Schools

Why is financial literacy important for students?

Financial literacy prepares students for real-life financial decisions, helping them manage their money wisely and avoid debt.

What are some effective methods for teaching financial literacy?

Using interactive lessons, real-world applications, and community involvement are effective ways to engage students in financial literacy.

Can financial literacy programs make a difference in schools?

Yes, many schools report improved student confidence and decision-making skills after implementing financial literacy programs.

How can parents support their children’s financial education?

Parents can reinforce lessons at home by discussing money management, budgeting, and encouraging saving habits.