Fed Rate Decision Jan 2025: Borrower Impact & Updates

The Federal Reserve’s anticipated interest rate decision in January 2025 is poised to significantly influence borrowing costs across various financial products, impacting millions of American consumers and businesses.

The financial landscape is ever-evolving, and few events command as much attention as a Federal Reserve interest rate announcement. With the next significant decision anticipated in January 2025, many are wondering: what does the Federal Reserve Announcement: Interest Rate Decision Expected in January 2025 – What It Means for Borrowers truly entail? This upcoming decision holds considerable weight, potentially reshaping everything from mortgage payments to credit card interest, directly affecting the financial well-being of millions of Americans.

Understanding the Federal Reserve’s Role in the Economy

The Federal Reserve, often referred to as the Fed, serves as the central banking system of the United States. Its primary mandate is to maintain maximum employment, stable prices, and moderate long-term interest rates. These objectives are crucial for a healthy and growing economy. The Fed achieves these goals primarily through monetary policy, with interest rate adjustments being one of its most potent tools.

When the Fed adjusts the federal funds rate, it doesn’t directly set the interest rates consumers pay. Instead, it influences the rate at which banks lend to each other overnight. This, in turn, cascades through the entire financial system, affecting a wide array of consumer and business loans. Understanding this mechanism is key to grasping the broader implications of any Fed decision. The ripple effect can be felt across various sectors, from housing to manufacturing, making every announcement a critical event for financial markets and everyday Americans alike.

The Federal Funds Rate and Its Influence

- Benchmark Rate: The federal funds rate is the target rate for overnight lending between banks.

- Broad Impact: Changes to this rate indirectly influence prime rates, mortgage rates, auto loan rates, and credit card APRs.

- Economic Levers: Raising rates typically cools an overheating economy by making borrowing more expensive, while lowering rates stimulates growth.

The Fed’s decisions are not made in a vacuum; they are the result of careful analysis of economic indicators such as inflation, employment data, and GDP growth. These factors provide a comprehensive picture of the economy’s health, guiding the Federal Open Market Committee (FOMC) in their deliberations. The transparency of this process, while sometimes complex, is vital for market stability and public confidence.

In essence, the Fed acts as a thermostat for the economy, adjusting rates to prevent it from getting too hot (inflation) or too cold (recession). This delicate balancing act requires foresight and a deep understanding of economic dynamics, making each meeting a pivotal moment for economic observers and participants. The January 2025 decision will be no exception, as the Fed navigates current economic conditions and future projections.

Anticipating the January 2025 Interest Rate Decision

As January 2025 approaches, financial analysts, economists, and everyday consumers are keenly watching for signals regarding the Federal Reserve’s next move on interest rates. While precise predictions are always challenging, several key economic indicators and historical patterns provide clues as to the likely direction. Inflation data, employment figures, and global economic stability are paramount in the Fed’s calculus.

Current economic projections suggest a complex environment. The Fed has consistently stressed its data-dependent approach, meaning any decision will hinge on the most recent economic reports. Factors such as persistent inflation, a robust labor market, or unforeseen geopolitical events could all sway the FOMC’s final verdict. Therefore, staying informed about these economic trends is crucial for anyone looking to understand the potential outcomes.

Key Economic Factors Under Consideration

- Inflation Trends: Is inflation moving sustainably towards the Fed’s 2% target?

- Employment Data: How strong is the job market? Is wage growth accelerating or decelerating?

- GDP Growth: Is the economy expanding at a healthy pace, or showing signs of slowdown?

- Global Economic Outlook: International events can influence domestic policy decisions.

The Fed’s communication strategy is also a vital component of its policy implementation. Forward guidance, where the Fed signals its likely future actions, helps to manage market expectations and reduce volatility. Any statements made by Fed officials in the months leading up to January 2025 will be scrutinized for hints about the committee’s prevailing sentiment and potential policy shifts. This ongoing dialogue helps prepare markets and individuals for upcoming changes.

Moreover, the Fed’s dual mandate of maximum employment and price stability often presents a delicate trade-off. If inflation remains stubbornly high, the Fed might lean towards maintaining higher rates or even increasing them further. Conversely, if signs of economic slowdown become more pronounced, a rate cut could be considered to stimulate growth. The January 2025 decision will reflect the Fed’s assessment of this balance.

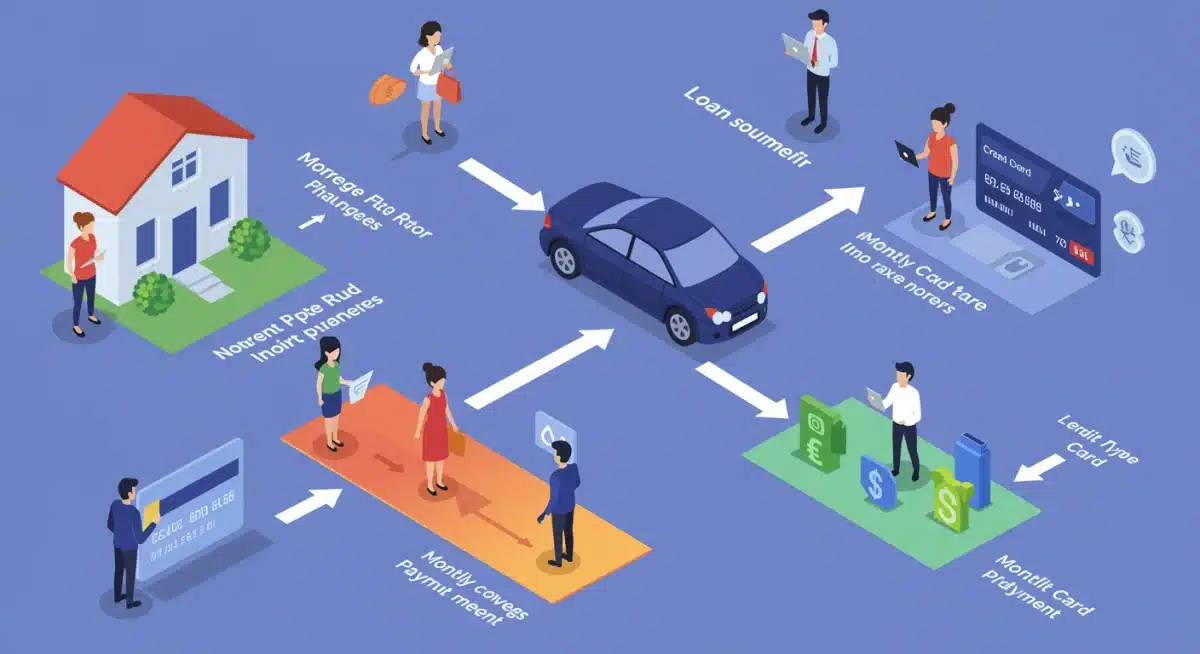

Direct Impact on Borrowers: Mortgages and Housing

For many Americans, the most tangible effect of a Federal Reserve interest rate decision is felt in the housing market, particularly through mortgage rates. Changes in the federal funds rate don’t directly dictate mortgage rates, but they significantly influence them. An increase in the Fed’s rate typically leads to higher borrowing costs for banks, which then pass those costs on to consumers in the form of higher mortgage rates.

If the Fed raises rates in January 2025, prospective homebuyers could face more expensive loans, potentially reducing their purchasing power and cooling down the housing market. Existing homeowners with adjustable-rate mortgages (ARMs) would also see their monthly payments increase. Conversely, a rate cut could make mortgages more affordable, stimulating demand and potentially boosting home sales. The housing sector is particularly sensitive to these shifts.

Mortgage Rate Scenarios

- Rate Hike: Higher monthly payments for new mortgages and ARMs, potentially slowing housing demand.

- Rate Cut: Lower monthly payments, potentially increasing housing affordability and stimulating sales.

- No Change: Stability, but market sentiment can still influence rates based on future expectations.

Beyond just monthly payments, higher mortgage rates can also impact refinancing opportunities. Homeowners who locked into lower rates previously might find it less attractive to refinance if rates climb. This can affect their ability to tap into home equity or reduce their overall interest burden. The decision in January 2025 will therefore have long-lasting implications for both new and existing homeowners.

Furthermore, the psychological aspect of rising rates can also play a role. When borrowing becomes more expensive, some potential buyers might decide to postpone their home purchase, leading to a decrease in market activity. This ripple effect extends to related industries, such as construction and real estate services, underscoring the broad reach of the Fed’s policy choices. Planning ahead for different rate scenarios is crucial for borrowers.

Credit Cards, Auto Loans, and Personal Debt

While mortgages often grab the headlines, the Federal Reserve’s interest rate decisions in January 2025 will also have a profound effect on other forms of consumer debt, including credit cards, auto loans, and personal loans. These types of borrowing are often more directly tied to the prime rate, which typically moves in lockstep with the federal funds rate. This means changes can be felt relatively quickly by consumers.

For credit card holders, particularly those carrying a balance, a rate hike means higher interest charges on their outstanding debt. Since most credit cards have variable interest rates, these changes can lead to an immediate increase in minimum payments and the total cost of borrowing. Conversely, a rate cut could offer some relief, reducing the financial burden on consumers struggling with high-interest debt.

Varying Impacts Across Debt Types

- Credit Cards: Highly sensitive to Fed rate changes, leading to immediate adjustments in APRs for outstanding balances.

- Auto Loans: New loan rates are influenced; existing fixed-rate loans are unaffected, but variable-rate loans would see changes.

- Personal Loans: Similar to auto loans, new fixed-rate loans would reflect current rates, while variable-rate options would adjust.

Auto loans, while often fixed-rate, are also affected by the Fed’s policy. When rates go up, the cost of financing a new or used vehicle increases, making cars more expensive overall. This can dampen consumer demand for vehicles and impact the automotive industry. Borrowers considering a car purchase in late 2024 or early 2025 should pay close attention to the Fed’s signals.

Personal loans, used for a variety of purposes from debt consolidation to home improvements, will also see adjustments. Both secured and unsecured personal loan rates are influenced by the broader interest rate environment. Understanding these connections allows borrowers to make more informed decisions about when to take on new debt or how to manage existing obligations. Proactive financial planning becomes even more critical during periods of rate uncertainty.

Strategies for Borrowers: Navigating Rate Changes

Given the potential shifts stemming from the Federal Reserve Announcement: Interest Rate Decision Expected in January 2025 – What It Means for Borrowers, it’s prudent for individuals to develop strategies for navigating these changes. Proactive financial planning can mitigate negative impacts and even help capitalize on favorable conditions. This involves reviewing current debt, understanding loan terms, and exploring options for refinancing or restructuring.

One of the most effective strategies is to reduce high-interest debt, such as credit card balances, before rates potentially increase. Paying down principal can significantly lower the amount of interest accrued, regardless of rate fluctuations. For homeowners, evaluating the benefits of refinancing a mortgage from an adjustable-rate to a fixed-rate loan could provide stability against future rate hikes. Timely action can make a substantial difference.

Key Strategies for Borrowers

- Debt Reduction: Prioritize paying down high-interest debt (e.g., credit cards) to minimize future interest costs.

- Refinancing Evaluation: Consider refinancing variable-rate loans (e.g., ARMs) to fixed rates for payment stability.

- Locking in Rates: If planning a major purchase (house, car), consider locking in current favorable rates if available.

- Building Savings: A stronger emergency fund provides a buffer against increased debt payments or economic shocks.

For those considering new loans, timing can be everything. If the Fed signals potential rate cuts, waiting to borrow could result in more favorable terms. Conversely, if hikes are anticipated, securing a loan at current rates might be advantageous. Consulting with a financial advisor can provide personalized guidance tailored to individual financial situations and goals, ensuring decisions are well-informed.

Furthermore, maintaining a strong credit score is always a beneficial strategy. A higher credit score can qualify borrowers for the best available rates, even in a rising interest rate environment. This reduces the overall cost of borrowing and provides greater financial flexibility. By taking these steps, borrowers can position themselves to better withstand economic fluctuations and optimize their financial health.

Long-Term Economic Outlook and Future Considerations

The Federal Reserve’s interest rate decision in January 2025 is not just a standalone event; it’s a piece of a larger economic puzzle. The Fed’s actions have long-term implications for inflation, economic growth, and the overall financial stability of the nation. Understanding these broader trends can help individuals and businesses make more informed strategic decisions beyond the immediate impact on borrowing costs.

Looking ahead, the Fed will continue to monitor a range of factors to guide its monetary policy. Global economic conditions, technological advancements, fiscal policy decisions, and consumer behavior all play a role in shaping the economic landscape. The Fed’s goal is to foster sustainable growth without triggering excessive inflation, a delicate balance that requires continuous reassessment and adaptation.

Anticipated Long-Term Trends

- Inflation Management: Continued focus on bringing inflation to target levels without stifling growth.

- Labor Market Dynamics: Monitoring employment figures for signs of overheating or weakness.

- Global Economic Integration: Acknowledging how international events influence domestic policy.

- Technological Shifts: Assessing the impact of innovation on productivity and price stability.

The January 2025 decision will offer insights into the Fed’s current assessment of these long-term trends and its projected path for monetary policy. This can influence investment decisions, business expansion plans, and even personal career choices. A stable and predictable economic environment, ideally fostered by sound monetary policy, is beneficial for all stakeholders.

Moreover, the Fed’s commitment to transparency and data-driven decisions means that future adjustments will continue to be communicated clearly. This allows markets and the public to anticipate and react to policy changes in an orderly fashion. Staying engaged with economic news and official Fed communications will remain essential for understanding the evolving financial landscape and its long-term implications.

| Key Point | Brief Description |

|---|---|

| Fed’s Role | Influences interest rates to manage inflation, employment, and economic stability. |

| January 2025 Decision | Anticipated rate adjustment based on inflation, employment, and global economic data. |

| Borrower Impact | Affects mortgage, auto, and credit card rates, influencing monthly payments. |

| Borrower Strategies | Reduce debt, evaluate refinancing, lock in rates, and build savings for financial resilience. |

Frequently Asked Questions About Fed Rate Decisions

The federal funds rate is the target interest rate set by the Federal Open Market Committee (FOMC) for overnight borrowing and lending between banks. It serves as a benchmark that influences other interest rates throughout the economy, including those for consumer loans and mortgages.

If you have an adjustable-rate mortgage (ARM), a Fed rate hike will likely increase your monthly payments. For new fixed-rate mortgages, rates will generally become higher, making homeownership more expensive for new buyers. Refinancing also becomes less attractive.

Yes, most credit cards have variable interest rates that are directly tied to the prime rate, which moves with the federal funds rate. If the Fed raises rates, the Annual Percentage Rate (APR) on your credit card balance will likely increase, leading to higher interest charges.

The Fed considers various economic factors, including inflation rates, employment data (such as unemployment rates and wage growth), Gross Domestic Product (GDP) growth, and global economic conditions. Their decisions aim to achieve maximum employment and price stability.

Borrowers can prepare by paying down high-interest debt, considering refinancing variable-rate loans to fixed rates, locking in favorable rates for upcoming major purchases, and building a robust emergency savings fund. Consulting a financial advisor is also recommended.

Conclusion

The upcoming Federal Reserve Announcement: Interest Rate Decision Expected in January 2025 – What It Means for Borrowers stands as a pivotal moment for the U.S. economy and individual finances. The Fed’s decision, whether a hike, cut, or holding steady, will send ripples through mortgage markets, auto loans, and credit card rates, directly impacting the financial health of millions. By understanding the Fed’s role, anticipating potential scenarios, and implementing proactive financial strategies, borrowers can better navigate these economic shifts. Staying informed and adaptable remains the most effective approach to managing personal finances in an ever-changing interest rate environment.